When it comes to your family, you want the very best for them in all aspects of life, and healthcare is no exception. Navigating healthcare options and the costs that come with them can be one of the most crucial yet challenging decisions you face. With an array of choices, confusing options, and complex financial planning, it is easy to feel overwhelmed. Our goal is to help you better understand health shares to determine if they might be the right solution for you and your family.

Based on data collected from 2019, the Kaiser Family Foundation highlights the significant impact that healthcare costs can have on household budgets. According to their report, “a family of four in good health with employer-sponsored coverage and earning $100,000 per year spends about 12% of their income on health care. If at least one member of the family reports worse health, household health spending increases to 15% of their income.” With healthcare costs on the rise, the need for and popularity of health shares has increased exponentially over the last few years.

What is a health share and how does it work?

A health share is an affordable alternative to traditional health insurance where members share in each other’s medical expenses. These health share programs encourage healthy lifestyles within a like-minded community that agrees to a set of common beliefs or principles. This community-driven approach fosters a sense of mutual support and shared responsibility.

Members contribute a monthly share amount that is used to pay for eligible medical expenses of other members. When a member incurs medical costs, they submit their bills to the health share organization. The organization then coordinates sharing these costs among the members, ensuring that eligible expenses are covered according to the guidelines of the program.

It is important to note that health shares are not considered insurance. While health shares can be a cost-effective option, it’s crucial for individuals to thoroughly research and understand guidelines, program options, sharing processes, and limitations before joining. For a closer look into health shares, see our blog called Getting to Know Your Health Share: 5 Things to Understand.

Health Insurance Costs vs. Health Share Savings

Health insurance cost breakdown:

Overall healthcare costs with traditional insurance include monthly premiums, deductibles, coinsurance, and copayments.

Note that costs can increase based on primary policyholder ages, insurance coverage options (knowing that lower deductibles have higher premiums), and adding additional family members to your policy. Premiums and other insurance costs can also vary by location.

The following data has been collected from various reports by Kaiser Family Foundation and Healthcare.gov and is based on unsubsidized, employer-sponsored health insurance.

Family of Four:

- Annual Premium (2023): $23,968 ($1,997/month)

- Deductible (2022): $3,811

- Out-of-Pocket Maximum (Marketplace 2024): $18,900

Individual:

- Annual Premium (2023): $8,435 ($703/month)

- Deductible (2022): $1,992

- Out-of-Pocket Maximum (Marketplace 2024): $9,450

Cost Trends:

- Premium Increase for Family Coverage:

- Last 5+ Years: 22%

- Last 10+ Years: 44%

- Primary Care: $26

- Specialty Care: $44

- Primary Care: 19%

- Specialty Care: 20%

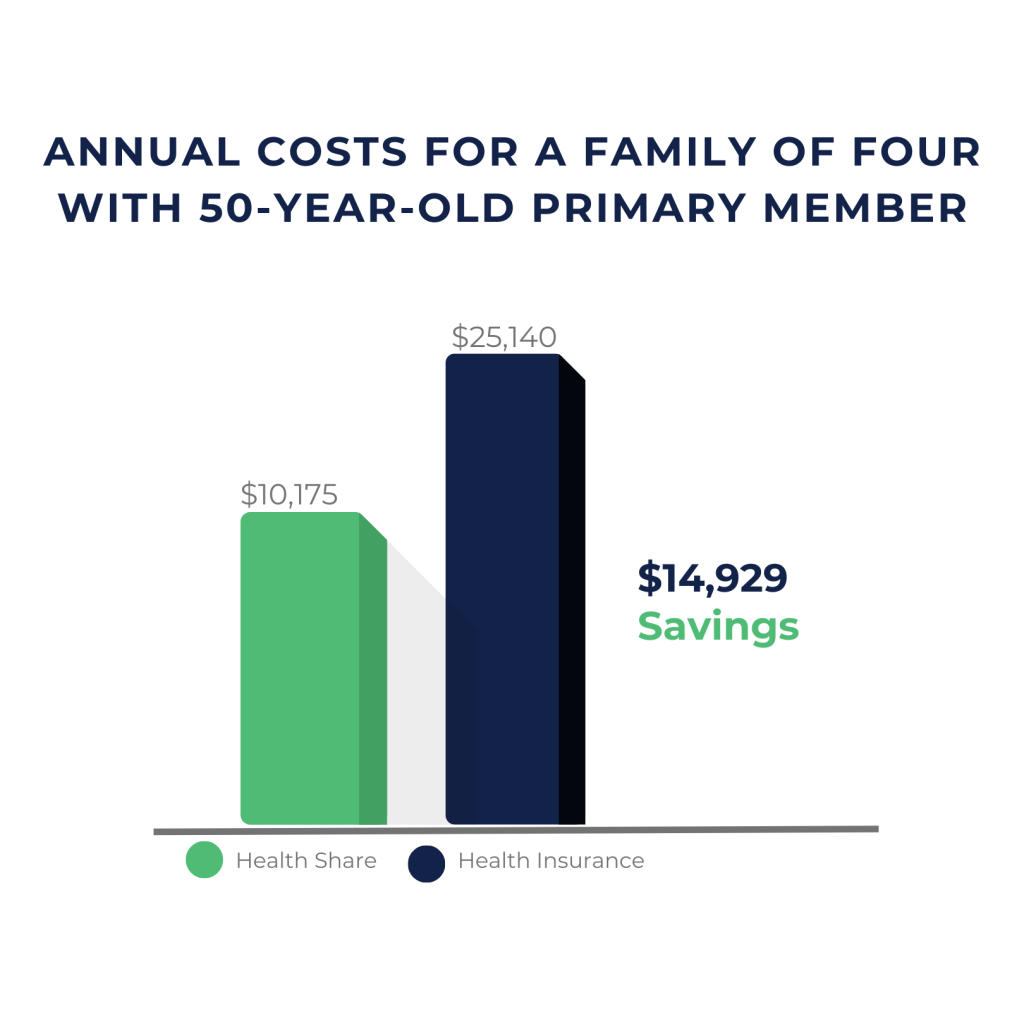

Average health share savings:

Overall health share costs include the member’s monthly contribution, a pre-share amount, and a possible co-share amount depending on the health share company. Also, depending on the health share company, a member might pay a visit fee.

Note that costs vary based on the primary member’s age, choice of pre-share amount, and how many members are in the household.

The following data has been collected from reports by HSA for America.

Health Share Savings for a Family of Four:

- Savings Potential: Members of a health share plan can save up to 50% or more.

- Estimated Savings:

- Monthly: Approximately $936 or more

- Annual: Approximately $11,232 or more

- Average Mid-Range Monthly Contribution with companies featured on Healthsharing Reviews: $575 per month for a family of 4 with a 40 year-old primary member.

- HSA for America Example: (chart averages from report)

How can choosing a health share help my family?

The number one reason people switch from traditional health insurance to a health share program is the significant savings. However, there are several other reasons why health shares can help both individuals and families alike.

- Control and flexibility to choose providers and personalized programs

- Transparency in how costs are shared or allocated

- Connection to the health sharing community

- No open enrollment time restrictions

Things to consider when choosing a health share program:

- Household or family size

- Financial planning: reimbursement vs. direct payments

- Choosing a provider vs. PPO network

- Pre-existing condition waiting periods

- Annual or lifetime limitations

- Age restrictions

- Add-on programs to round out your needs

- Sharing in vision, dental, prescription, mental health, and alternative services

- Group or employee programs

- Shareable vs. non-shareable eligible expenses

- Predictions of your medical needs, like:

- Individual, family, senior

- Medical visits typically used

- Prescriptions typically used

Health share programs offered:

Health share companies offer a variety of programs to meet different needs. The membership types include catastrophic, individual, family, and senior memberships. Within these membership types, the various programs range in services such as:

- Emergency or urgent care

- Annual wellness visits

- Maternity care

- Specialty visits

- Preventive care

- Mental health

- Telemedicine services

Additionally, some health shares offer dental share programs or discounts, as well as vision and prescription discounts. Pre-existing conditions are covered after following the specific waiting period guidelines set by each company, which can vary.

Specialized programs

- DPC and health shares

Direct Primary Care (DPC) is a healthcare model that offers a direct relationship between patients and primary care providers. By paying a monthly membership fee, patients gain unlimited access to a range of primary care services without incurring additional fees at the time of service. By combining DPC with a health share, members can manage their primary care needs through the DPC membership and use health share funds for larger, unexpected medical costs. This approach fosters personalized, accessible, and community-driven healthcare, bypassing traditional insurance companies.

In conclusion, determining which health share plan is right for you involves a variety of considerations, including your financial situation, services needed, personal health, and values. It is important to weigh the advantages and disadvantages of health share plans before choosing a program. It is also key to carefully review the guidelines of prospective health shares, as they can differ in their sharing requirements. Careful attention to these factors can help you throughout your healthcare journey.

Kaiser Family Foundation. 2019. “The Real Cost of Health Care: Interactive Calculator Estimates Both Direct and Hidden Household Spending.” [https://www.kff.org/health-costs/press-release/interactive-calculator-estimates-both-direct-and-hidden-household-spending/#:~:text=A%20family%20of%20four%20in,to%2015%25%20of%20their%20income.]