This was the top question from our poll on Facebook—the thing people are most curious about when it comes to health shares.

You’ll find that health shares can share in almost anything people typically look for—but it’s important to know that no single health share shares in everything.

Each program has its own guidelines, and what’s shared depends on how the community is structured. That’s why choosing the right health share really comes down to your preferences, priorities, and what kinds of medical needs matter most to you or your family.

We’ll go over some of the most commonly shared medical expenses below—along with the ones that are less common among health shares that you may not expect.

What Health Shares Typically Share In

Less Common (But Often Shareable)

*NOTE: Limitations may apply, particularly for pre-existing conditions, specialized services, or those with capped sharing amounts.

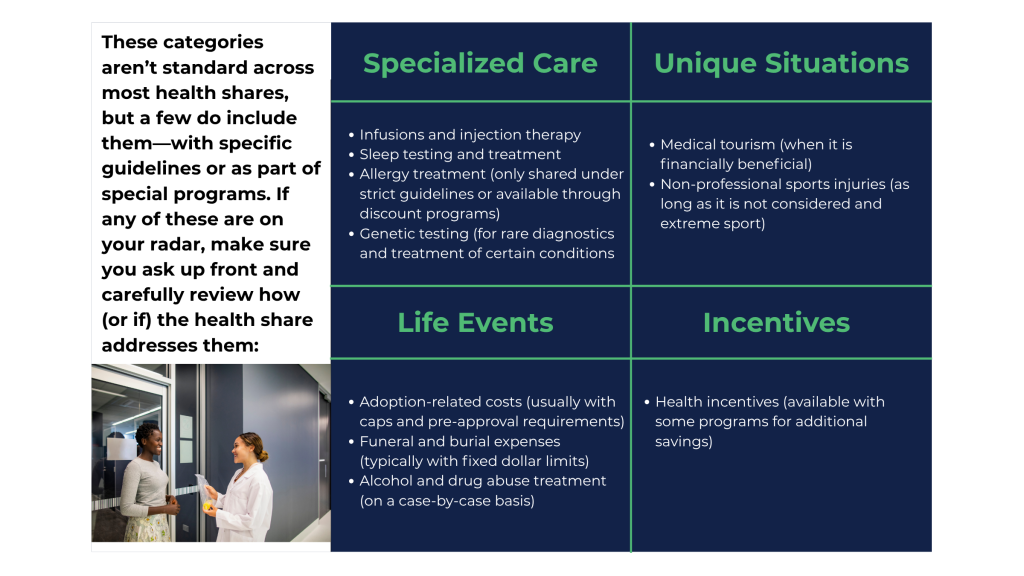

Rare or Uncommon (But Occasionally Shared)

*NOTE: Limitations may apply, particularly for pre-existing conditions, specialized services, or those with capped sharing amounts.

A Quick Note on Eligibility

Even if a medical need is eligible, most health shares require members to follow specific steps—like submitting itemized bills on time, perhaps getting pre-approval, or meeting a personal responsibility amount before sharing begins.

Some programs also have annual or lifetime sharing limits. Always review the Member Guidelines to understand the limitations and submission process.

Ready to Explore Your Options?

Visit HealthsharingReviews.com to compare programs side by side, read real member reviews, and get a better sense of what to expect. Your experience can help others too — take a moment to leave a review and share what’s worked (or what hasn’t).

Join the Conversation

This blog was inspired by real questions from our Facebook community.

Want to be part of future polls or discussions? Follow us and share your experiences!

Other Top Questions We Heard

What exactly is a Health Share?

It’s a community of people who help share each other’s medical expenses. It’s not insurance, but it’s often used as an alternative — especially by self-employed individuals or families looking for lower costs and more flexibility.

For mor detailed information, read our blog: https://healthsharingreviews.com/what-is-a-shared-health-network/

Can I use health shares for my family or business?

Yes! Health shares offer a variety of options for individuals, couples, and families. Some even have group solutions for businesses, big and small.

Family: https://healthsharingreviews.com/choosing-the-right-health-share-plan-for-your-family/